We interrupt your coronavirus panic for a quick overview of what to expect this year from eCommerce, and which opportunities brands can act on now.

The impact of COVID-19 on eCommerce is unclear

Early results in the US are showing a lift in eCommerce sales (Quantum Metric) - this could be driven by a drop in spend on travel and eating out, combined with boredom-induced couch shopping. I'm certainly seeing this with my own clients, many of whom have seen a drop in foot traffic to stores but a lift online and in paid media returns.

However, depending on the industry, the outlook is unclear - supply chain issues is already starting to impact many retailers even as China is coming back to life, and sales for non-essential items like fashion and beauty could suffer as the economy slides into recession. All we can do at this stage is wait and prepare for a dip.

The good news for businesses who aren't online yet is that eCommerce might open up a new stream of revenue in these uncertain times - Butterbing Cookies were able to setup an online store on their Wordpress site in just two hours with the Shopify Buy Button.

Big sales are bigger than ever

For a second year running, Black Friday/Cyber Monday week was the largest week in eCommerce, seeing a 31.6% growth year on year. Online spend for the two weeks to Christmas was only up 18% by comparison. We call it a "week" these days, because many brands are starting sales as early as the Monday ahead of Black Friday in an attempt to cut through the noise.

The Opportunity: Mark your calendar with key sale periods and start planning ahead now - ensure your eCommerce platform is ready to handle a drastic increase in traffic come November 2020 and start thinking about creative ways to differentiate your brand in a very busy period (eg. early access for VIPs, new communication channels).

Buy Now, Pay Later is here to stay

BNPL stocks may be down with the market at present, but reports show their use has almost doubled in the past year - with around 1 in 10 Australians using a BNPL service in 2019. For many of my clients, up to 25% of monthly transactions use AfterPay as the payment method - at an average fee of 4-6% per transaction, that's substantial.

Now with the entry of UK's KlarnaPay, the big players including will be facing much stiffer competition for retailers and their customers which might see a dip in what many retailers have found to be extremely high transaction fees. Many retailers are starting to offer all options for a better customer experience, removing the AfterPay advertising from their sites which it so greatly benefited from in the earlier days.

The Opportunity: For retailers, the key upside of BNPL is an increase in conversion rates - that said, it's hard to assess this. If you use one or several, make sure you know what percentage of your transactions use BNPL (what it's costing you each month in transaction fees) and weigh it up against your profit margins. Take advantage of marketing opportunities for new customer acquisition.

Mobile continues to dominate traffic

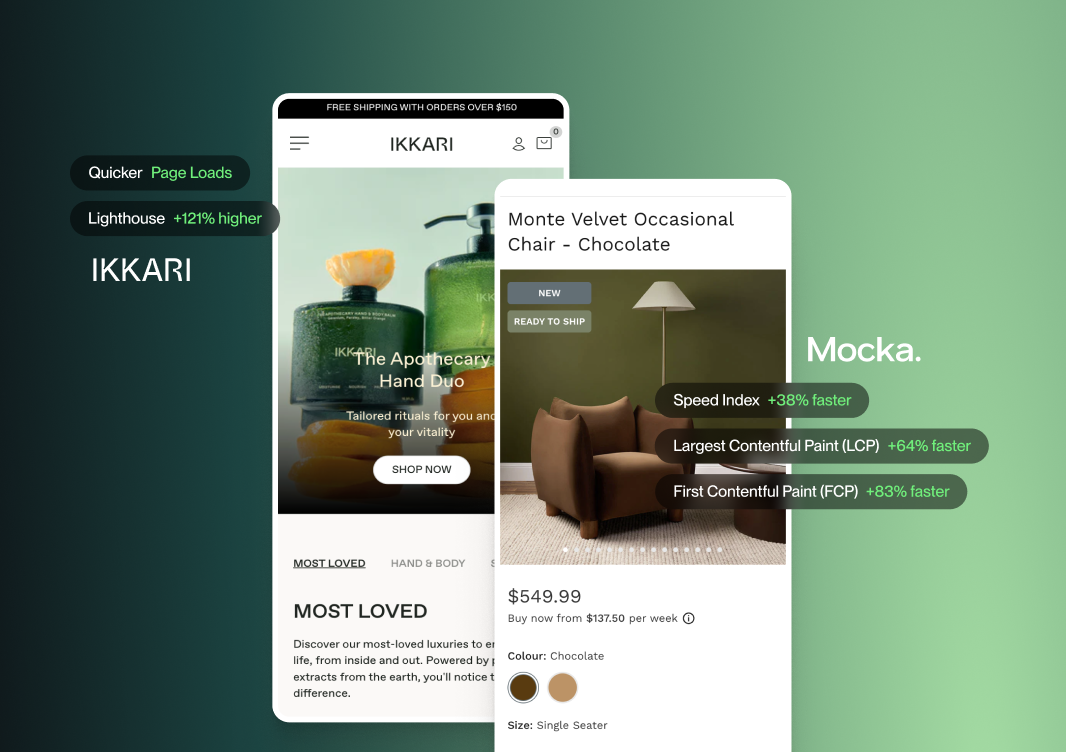

In 2019, 41% of Australian customers preferred to shop on a mobile device, up from 37% in 2018 (Paypal) and mobile's share of eCommerce traffic continues to grow. For many of my clients, mobile makes up 75% of total site traffic, as most of their advertising spend is going into social advertising. Whilst many customers still complete checkout on a desktop, mobile is generally their first experience with a brand and where they do the exploring.

I say this a lot, but it's still true: the problem is, we mostly manage eCommerce stores on a desktop, so we often forget how the customer is experiencing the site and the pain points they may have with it. Agencies and brands call themselves mobile-first, but most of the time it's just lip service. They're still cramming desktop designs into a mobile format, without thinking of the mobile user's needs first.

The Opportunity: Don't get lazy. Test everything on mobile - eDMs, your online store experience and ad creative. Watch customers browsing your site on mobile and identify the problem areas. Some of my favourite mobile experiences include Everlane, Frank Green and Nimble Activewear.

Brand storytelling is no longer a nice to have

As online advertising costs rise and price competitive marketplaces like Amazon continue to grow, the direct-to-consumer brands who are still killing it online are those who are winning the hearts and minds of their customers. They're listening to what their customers want, what their pain points are and investing in content creation that resonates with them and builds long-lasting loyalty and bigger owned channels.

A classic example of this is the rise in video advertising across Facebook and Instagram - pretty pictures just don't get the results they used to. Brands need to communicate why they exist, why they're different and the value they can offer, all in 15 seconds.

The Opportunity: If you haven't invested in a clear, easy to communicate brand identity beyond a logo, it's time to start workshopping it internally or engage a brand strategist. Check out some brands who are doing it well and find your own unique spin: Go-To Skincare, The Memo, West Elm and Away Travel.

Sustainable retail is a growing expectation

This is not a fad - as millennials spending power continues to grow, brands are having to rethink everything from their production lines through to their packaging - because customers are asking. Customers are increasingly expecting transparency from brands around where and how products are made and delivered.

It's a complex topic, but here are some interesting examples of brands taking action: Nimble Activewear produces the majority of their fabric from recycled plastic bottles and has introduced corn-based recyclable packaging. Kester Black ships only 3 days a week to reduce their carbon footprint. Even fast fashion giant H&M and The ICONIC have set up recycling programs for used fashion items.

The Opportunity: Review your supply chain and identify some changes that can be made which are still conducive to a growing business. Pre-empt customer questions with a dedicated page on your store addressing sustainability & ethics, and weave sustainability efforts into your brand story where appropriate.